Bullish bias for the week.

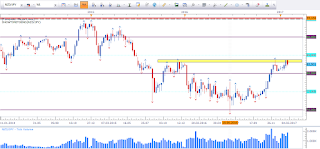

This is EUR vs USD weekly timeframe. Price did pring a Hammer above 1,05. This puts my bias in favour of the bulls.

EUR vs CAD

Bullish bias for the week.

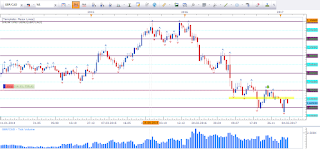

This is EUR vs CAD weekly timeframe. As mentioned last week (here) price was sitting at support and we had a test of support with last week close. The Hammer candle puts my bias in favour of the bulls. Above support I am bullish. The overall trend is bearish with price pringing lower lows and lower highs. Howver, price seems to enter a range.

AUD vs CAD

Bearish bias for the week.

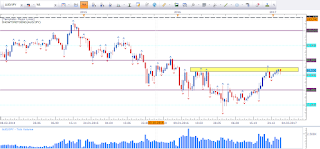

This is AUD vs CAD weekly timeframe. Price is at an interesting location and printed an indecision candle at resistance. As long price stays below 61,8 Fib level (as reference) I am bearish.

CAD vs JPY

Mixed signal.

This is CAD vs JPY weekly timeframe. This is an interesting asset worth keeping an eye on. Even though last week formed a Rejection Candle, price is above support. I need more information to derive a bias.

NZD vs JPY

Mixed signal.

This is NZD vs JPY weekly timeframe. Price did bounce off resistance and is currently approaching support. As long price has not been violated I'll maintain a bullish bias (above support). However, price is has not formed a setup, hence the mixed signal.

GBP vs CAD

This is GBP vs CAD weekly timeframe. This asset is interesing. Currenlty price seems to find minor support. Price has not been able to violate last week and the previous week low. A close below last week/previus week low would be bearish sign. Looking at the market structure, we have all signs of a bearish trend. Lower lows and lower highs. The last low however is interesting. Price did print a lower low. However, it was a gap down. The Gap got filled initially. I'll maintain my short position and give it the chance to prove itself.

AUD vs NZD

This is AUD vs NZD weekly timeframe. Price is approaching an interesting level. As long price stays below the marked level, my bias is bearish. However, we do not have a signal as of yet.

EUR vs NZD

Bullish bias for the week.

This is EUR vs NZD weekly timeframe. This is an interesting asset. Price did print a Hammer two weeks ago, which bascially is a bullish reversal formation. However, it was not at an ideal location. I do not like the current level as much as the yellow zone. But price did print a bullish reversal pattern at support, which does put my bias in favour of the bulls.

EUR vs JPY

Mixed signal

This is EUR vs JPY weeky timeframe. There is no setup as of yet, however price is at an interesting level. This level has been resistance, got violated and became support, then got violated again. Last week was not able to violate the low the rejection candle (low of the previous week). Last week indecision candle shows minor support. I'll keep an eye on this pair.

USD vs JPY

Mixed signal.

This is USD vs JPY weekly timeframe. Last week did boune nicely off the orange zone. Unfotunately I was not able to get in. I am keeping an eye on this one. So far there is not really a setup, as price is above support and below resistance.

GBP vs JPY

Mixed signal.

AUD vs JPY

Mixed singal.

This is AUD vs JPY weekly timeframe. This pair displays a diffferent picture compared with the other JPY pairs. Basically we have a bearish reversal pattern with the Shooting Star right at resistance. But being so close to support, I am not interested in shorting this pair. I'll keep an eye on this asset as it is highly interesting.

AUD vs USD

Bearish bias for the week.

This is AUD vs USD weekly timeframe. Price is at resistance, and printed a Doji. There is no setup as of yet. But as long resistance has not been violated I'll treat resistance as resistance.

EUR vs AUD

Bullish bias for the week.

This is EUR vs AUD weekly timeframe. Last week did close as a Hammer above support. The location is not ideal thougth. But the lower wick shows rejection of lower prices hence support. We may see price approaching the support level marked with grea rectangle again.

EUR vs GBP

Mixe signal.

NZD vs USD

Mixed signal.

This is NZD vs USD weekly timeframe. While I my bias was bearish last week (see here) based on the Bearish Engulfing Pattern at resistance, this week my bias did shift to neutral. Price formed an Indecision Candle at support with last week close. As the trend is bullish, chances are good we see support holding. The weekly close will shed more light.

USD vs CAD

Mixed singal.

This is USD vs CAD weekly timeframe. There has not been much of change from last week analysis. I am looking for a close above the red horizontal line for a bullish sign or a close below 1,30 for a berish sign. With price at current level, I am on the sidelines.

Happy trading,

TT