Mixed signal.

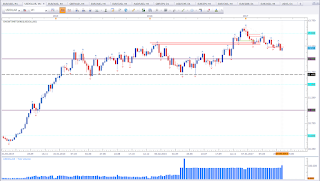

This is EUR vs USD weekly chart. Last week I was talking about this pair (here). Basically the bias has not changed. The trend is still bullish. Price now seems to be bouncing off a resistance level. This level is not far from the range top which I am expecting to get tested. Being close to resistance and having the Indecision Candle with a rather long upper wick at resistance, I am not much inclined to look for long setups. Chances are increased to see a pullback from current levels. I will get highly interested in EUR vs USD when price is at the extremes of the range. So this asset is very worth to keep an eye on.

EUR vs CAD

Mixed signal.

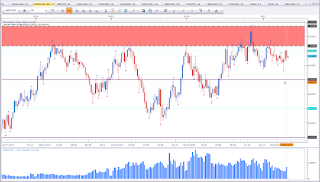

This is EUR vs CAD weekly chart. Above 1,50 I am bullish. But last time price was at current levels, price pushed violently down. Last week formed a Dark Cloud Cover at a level of interest. This is a bearish reversal pattern. We may see the beginning of a pullback from the last bull move. A weekly close below 1,50 would confirm the bears and we should see a move down probably to around the 1,45 area. But time and price will tell.

EUR vs NZD

Bearish bias for the week.

This is EUR vs NZD weekly chart. The weekly medium trend is bullish with two higher highs and two higher lows. However, price formed a Bearish Engulfing Pattern with a close below 1,60 together with a bounce off a previous low. This sets my bias in favour of the bears for the week. I am aware that price is close to a previous range top level, which may cause trouble for the bears. But a setup is a setup. And the setup sets my bias in favour of the bears until proven wrong.

GBP vs USD

Bearish bias for the week.

This is GBP vs USD weekly chart. At first I wanted to state my bias is mixed. However, a setup is a setup. We have a bearish setup. Last week closed as a Bearish Engulfing Pattern. This is a bearish reversal pattern. The location is also good. We have a previous low and a close below 1,30. This puts my bias in favour of the bears. Let me refer here to the cross currency anaylsis at the bottom of the page.

EUR vs JPY

Bearish bias for the week.

This is EUR vs JPY weekly chart. Last week formed a Tweezers Top with a Shooting Star as the second candle. This puts my bias in favour of the bears. Price did break a swign high. But the break above is rather weak and a sign for a toppish structure.

USD vs JPY

Mixed signal.

This is USD vs JPY weekly chart. Whatever I wrote last week about this asset is valid this week (see here). Last week did form a Doji inside the previous week. A Doji could be looked at as a reversal pattern. Here the Doji formed at a support level which would indicate bullishness. However, the Doji is inside a bearish reversal pattern. A break of the Doji on either side could be taken as a sign but that would be an aggessive approach.

AUD vs USD

Bearish bias for the week.

This is AUD vs USD weekly chart. Price is in the middle of the weekly range. I do not like to trade inside the range. However, price shows a bearish trend inside the range. Last week did form a Shooting Star and is bouncing off a low that got broken. The 0,75 level proved to be significant. This level may be the new lower high. As an odds enhancer we my want to have a look at the USD-Index which is done at the bottom of the page.

EUR vs AUD

Mised signal.

This is EUR vs AUD weekly chart. Price made a strong move up since mid April. Markets do not run in straight lines. Last week closed as an Indecision Candle at a resistance level. This transfers to not looking for long oppotunities. I am more interested in bearish setups. The Indecision Candle itself is not a setup. However, this formation indicates a possible reversal. If we get a close below the Indecision Candle, we will have the bearish setup.

GBP vs AUD

Bearish bias for the week.

This is GBP vs AUD weekly chart. Last two week we had a congestion. Last week did break out to the downside. This sets my bias in favour of the bears.

FXCM USDOLLAR

Bearish bias for the week.

This is FXCM USD-Index weekly chart. Price is making lower lows and lower highs. The distance between the lows and the highs is not big which may be a sign of weakening bears. But as long this behaviour does not change, the bias is bearish. I did place a decending trendline highlighting the immediate trend. We did have a break below the most recent low recently and price is testing this low. We can still argue that Price is in the vicinity of support and look at the Indecision Candle as a reversal pattern. However, I need a close above the trendline as a first sing of a resumption of the bulls. As long price is not able to close above the trendline, which should come in with a close above the lowest high, the bias remains bearish.

Cross-Currency-Analysis

This is an interesting week.

Earlier I made a reference on GBP vs USD to this section of the weekly analysis. EUR vs USD and GBP vs USD are strong positive correlated. That means, you do not want to short one pair and go long the other pair. While my bias on EUR vs USD is mixed, I have a bearish bias on GBP vs USD. Now we need to have a look at the USD-Index to help us. The Index is bearish. Refer to the above chart. Last week did pull back to test the support level that got broken. As long USD is weak, I am not interested in shorting GBP vs USD. Same applies for the bearish bias I have about AUD vs USD. At this stage we cannot know if GBP vs USD and AUD vs USD are early indications for USD stength. If so, we should see a strong USD. That would be still inline with my view about a test of 1,10 in EUR vs USD and the bearish bias I stated above about the GBP vs USD and AUD vs USD.

Maybe other assets may give more insight. Looking at EUR price is at resistance across a couple analized pairs. While I have a bearish bias on EUR vs NZD and EUR vs JPY my bias is mixed on EUR vs CAD and EUR vs AUD. However, EUR vs CAD and EUR vs AUD are at a level of interest. While we have a reversal pattern on EUR vs CAD I am waiting for the weekly close to confirm the bears. This transfers to a rather weak EUR, which puts weight in favour of a pullback in EUR vs USD (meaning a test of 1,10).

Looking at AUD, I have a bearish bias on GBP vs AUD. This indicates AUD strength. However, we need more assets to draw conclusions. EUR vs AUD is at a resistance level and formed an Indecision Candle. While this formation alone is not really a setup, it indicates possible AUD strength and EUR weakness. This is in contrast to the bearish bias on AUD vs USD, which indicates AUD weakness.

The Cross-Currency-Analysis can get pretty complicated as seen above. This form of analysis is mainly to help in the decison making process. My trading decisions are not based on this form of analysisn. But I like to draw conclusion across other currencies to enhance the odds of my trading ideas.

Thank you for reading. If you have any questions, please leave any questions in the comments section below.

Happy trading,

TT