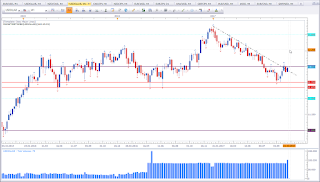

EUR vs USD

Bullish bias for the week.

|

| EUR vs USD |

This is the weekly chart of EUR vs USD. This asset is in the process of a trend shift. Price did break out of the range, I am expecting a pullback. Price did pull back and formed a bullish reversal pattern at a level of interest. We have a Bullish Engulfing Pattern at support. This signal is a bullish signal. So my bias is bullish. Ideally we had seen a pullback to the black line and get the bullish reversal signal at that level. But we do not always get what we want. We have a bullish signal at a level of interest. I'll be looking for long opportunities. However, I still favour a move to the black line. That means I am not eager to trade this asset long. I am fine letting a trade pass. If I get a suitable setup, I'll happily take the trade.

CAD vs JPY

Mixed signal.

|

| CAD vs JPY |

This is the weekly chart of CAD vs JPY. Two Indecisin Candles in a row catch my attention. Price is at a level of interest. So I stay alert with my neutral bias. We may seem some interesting moves here.

NZD vs JPY

Bullish bias for the week.

|

| NZD vs JPY |

This is the weekly chart of NZD vs JPY. Price formed an Indecision Candle with a rather long lower wick showing a rejection. This candle could pass as a Hammer. The rejection did happen at a level of interest. This puts my bias in favour of the bulls.

EUR vs NZD

Bearish bias for the week.

|

| EUR vs NZD |

This is the weekly chart of EUR vs NZD. Last week failed to violate the high and formed a Shooting Star. This puts my bias in favour of the bears.

USDOLLAR

Bearish bias for the week.

|

| USDOLLAR |

This is the weekly chart of FXCM USDOLLAR. FXCM has it's very own USD Index, which is slighlty different than the classic Dollar Index. However, the FXCM Dollar Index is useful for the analysis nevertheless. Price failed to violate the high I was talking about last week (see

here) and formed a Bearish Engulfing Pattern at the 12 level. This puts my bias in favour of the bears and adds more bullish fuel to my thoughts about EUR vs USD.

EUR vs JPY

Mixed signal for the week.

|

| EUR vs JPY |

This is the weekly chart of EUR vs JPY. We have two Inside Candels. Last week did close as a Tombstone Doji. In the context of the current market structure we could talk about an Inverted Hammer, which basically is a bullish reversal pattern. I personally favour to see a weekly close above the two Indecision Candles before I talk about a bullish bias. If I see a setup at the red horiziontal line, I am very inclined to take the trade.

AUD vs USD

Bullish bias for the week.

|

| AUD vs USD |

This is the weekly chart of AUD vs USD. Price did form a Bullish Engulfing Pattern at the previous range resistance level, which should act as support now. The Bullish Engulfing Pattern at Support puts my bias in favour of the bulls.

EUR vs AUD

Bearish bias for the week.

|

| EUR vs AUD |

This is the weekly chart of EUR vs AUD. Price failed the third time to violate the swing high. Last week did form a Rejection Candle. This puts my bias in favour of the bears. A conservative approach would be to wait for the violation of the trendline.

NZD vs USD

Bullish bias for the week.

|

| NZD vs USD |

This is the weekly chart of NZD vs USD. Price formed a Piercing Pattern at a level of interest. This and the bearish bias for USD puts my bias in favour of the bulls.

AUD vs CAD

Bullish bias for the week.

|

| AUD vs CAD |

This is the weekly chart of AUD vs CAD. Price formed a Bullish Engulfing Pattern at a confluence support level (see the trendline and the two parallel red lines. This puts my bias in favour of the bulls. However, take note that price is still inside the big bearish mother candle.

Cross Currency Analysis

The two assets that stick out are AUD and USD. AUD presents strength throughout the pairs and USD is weak. This makes AUD vs USD an interesting asset to trade.