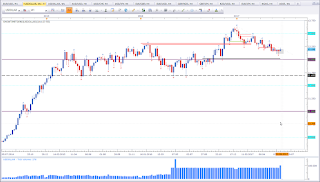

Lets look at the red arrow in the below chart. Before the candle closed, we have a break above a previous high. Breakout traders love to see highs taken out and position themselves. Either a pip or a bigger buffer above the high. Or depending on the timeframe e.g. 5 min chart with a close above. The close serves as a confirmation of a successful break. As you can see, price did move quite some distance above the previous high. And on lower timeframes this looks even more promissing. But then price reverses. There are many differnet type of longs in at this point. Those who missed the longs at lower prices that jump in, Breakout traders, and those that already have been long at lower prices. Some of those traders that took the break of the previous high get scared and close their position. These scared traders add fuel to the bears. There will be also some that expect a pullback to the broken high. But as you can see price moves below the high. And here most of the breakout traders and those that were long form lower levels either close their longs or they get stopped out, as their stops are regularly below the swing high that got broken (support).

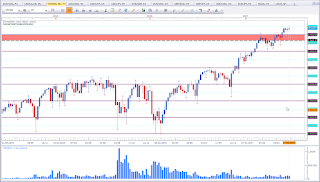

Now the H4 candle closed as a big Shooting Star / Pinbar. The level is sound. A Shooting star at resistance. There is a fakey (a breakout that failed). There will be many traders that look to short this asset now. The eager ones take the short with the close of the Shooting Star. Others will wait for the break of the Pinbar. And then there are those that trade the smaller timeframes. I personally like such pinbars and would also get tempted to trade this. So am not blaming those that take the short. Fortunately the low never gets pierced so those wating for a break are lucky. The supposed short setup, which is at the same time a fakey (a fake breakout) is a trap for those that short. Most traders who have been long from lower prices get scared and exit their trades, which is not to be blamed. But price continues to move higher. And now short stops get taken out. Eventually the high of the pinbar gets breached, but price retraces again. Those that think now is the time to make some pips jump on board and take the long trades and we have another stop hunt. We have a Bearish Engulfing Pattern.

This is the reason why we do not want to be the early bird. There are predators waiting for their bait. Let others be the bait.

Lets look at the second (green arrow). Below is the same chart again to make reading easier.

We have a big pinbar. I don't like the location of the Pinbar (Hammer) as it is not at the bottom. But the formation is the same. The interesting point I would like to draw your attention to is, look at how far the low of the pin went. I takes out the previous low (swing low). At the beginning of the H4 Pinbar price was moving up. To some traders this looks like the early stage of a bullish trend (higher high and higher low). To others, this is a pullback of the bigger bearish move from 17,75. At the open of the Pinbar, price is also testing a resistance level. As price moves lower, we have those traders that think this is a bullish market, that get scared. So they close their open longs for small profits or and we have those bullish traders that get stopped out as they have their stops below the former higher. In addition to these bullish traders that are in a loss, there are those traders that see the end of the pullback (of the bearish move) and take their short trades. Either on lower timeframes with the violation of the lows (we have a bullish trend on the m5 timeframe up to the start of the pinbar) or those that have pending shorts at the resistance level as they trade the level. Price moves nicely south and takes out the lows. There are many stop orders below that low. All those stops get triggered and then the market moves up without any of these traders that got engaged already.

At this point it is very difficult to tell what will happen next. Price is testing again the low with another rejection candle (but big body). We may see price move back up. But I kinda doubt that. What I am certain off is, I am not going to swim with the shark and risk my Butt getting bitten.

I also marked some candle lows with a red rectangle at the left of the chart. We have Pinbars and Rejection Bars. The stops of the long traders got triggered. This is also a stop hunt. Carl taught us a nice way to avoid this situation. If the long traders had waited for the FFB, they would not have been victims of stop hunters. There is no way to avoid all losses. Everybody will lose. There is no way to avoid getting stop hunted. This is the very reason why we have to be patient and evaluate our trades as price moves. They key word is patience. Be able to adapt to chaning environments. and by all means: DO NOT GET GREEDY

Don't have the profit in your eyes, but always the risk that comes with the trade. Risk is the only thing we have can influence.

Thank you for reading, If you have any questions please put them in the comments section below.

Happy trading,

TT