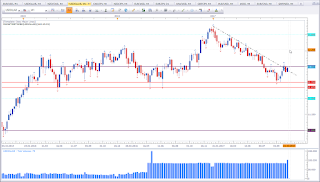

EUR vs USD

Mixed signal.

|

| EUR vs USD W1 |

This is the weekly chart of EUR vs USD. Price was not able to violate support, nor was price able to break the top of the Bullish Engulfing Pattern. Last week closed as an Inside Candle. Price is indecisive at a level of interest. Personally I would like to see price move south to test the previous range level (black horizontal line). But we do not always get what we want. As traders we have to work with what we see. And that is currently Indecisive at support. As long support holds, treat support as support. I do not need to be in a trade, so I am fine waiting another week or two for a good setup to trade. A look at the Dollar Index will help me in the decision making process.

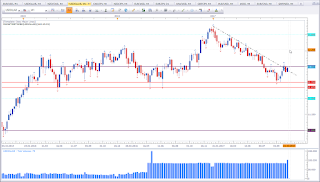

EUR vs CAD

Bullish bias for the week.

|

| EUR vs CAD W1 |

This is the weekly chart of EUR vs CAD. I was talking about this asset the previous week (see

here) and the price only took of last week unfortunately without me. Having established a bullish bias does not necessarily mean I am going to buy this asset. It also means I am going to avoid to sell this asset. Having a bias reduces the vast amout of trading opportunities, which may prove to be essential.

CAD vs JPY

Mixed signal.

|

| CAD vs JPY W1 |

This is the weekly chart of CAD vs JPY. Price formed the 3rd Indecision Candle in a row at a level of interest. The last candle could classify as a High Wave Candle. As you can see by the black dotted lines, price failed to violate the first Indecision Candle (on a weekly basis).

AUD vs NZD

Mixed signal.

|

| AUD vs NZD W1 |

This is the weekly chart of AUD vs NZD. Basically the structure is bullish. If price had not been this close to the resistance level marked with the red line, I'd have labeled this asset as bullish. Price is making higher highs and higher lows. This is the classic definition of a bullish trend. Price is now approaching about the fourth time this level. Either we'll see a violation or a bounce. Only time will tell. This asset is very interesting. Keep an eye on this one.

EUR vs NZD

Mixed signal.

|

| EUR vs NZD W1 |

This is the weekly chart of EUR vs NZD. This asset is quite interesting. Notice how last week did violate the previous Pinbar. That was a nice beatish setup. But it failed (mainly because of NZD news). If you have not read my article about Pinbars, you can find it

here. This asset shows the classi signs of a bullish trend i.e. a series of higher highs and higher lows. This basically this puts my bias in favour of the bulls, hence I'll avoid shorting this asset. But price is approaching a level of interest and we may see a reaction here.

USDOLLAR

Mixed signal.

|

| USDOLLAR W1 |

This is the FXCM Dollar Index. The question that arises now is, did we form a lower high? Price was not able to violate the 12 level and formed a Piercing Pattern at a previous congestion area. At this moment, I don't give the Piercing Pattern (bullish formation) much value. If we are going to see USD strength, price has to break and close above the 12 level. Below the 12 level I tend to be neutral or bearish. Unfortunately this asset is not helpful to evaluate EUR vs USD. I am not rather neutral to bearish this asset.

DAX 30

Mixed singal.

|

| DAX 30 W1 |

This is the weekly chart of DAX 30 (FXCM Ger30). Price did form the second Doji in a row. Hence this asset did catch my attention. The trend is bullish, so I am not keen on counter trend trading this asset. But I'll keep a keen eye on this for potential setups. A close below the Doji would be a bearish signal.

EUR vs JPY

Bullish bias for the week.

|

| EUR vs JPY W1 |

This is the weekly chart of EUR vs JPY. Last week I did talk about this asset and mentioned I'd like to see a close above the two Indecision Candles. I also talked about the Tombstone Doji. (

click here).

Last week candle engulfs the two previous candles. And this happens at a level of interest in a bullish trend. This puts my bias in favour of the bulls. But price is very close at the swing high which can act as resistance.

Copper

Bearish bias for the week.

|

| Copper W1 |

This is the weekly chart of Copper. Price formed a Shooting Star at a previous trouble area and the swing high. This puts my bias in favour of the bears.

Hope you enjoy my weekly analysis. If you have any queations or feedback please leave them in the comments section below.

Happy trading,

TT

Keine Kommentare:

Kommentar veröffentlichen