EUR vs USD

Bearish bias for the week.

This is EUR vs USD weekly timeframe. Price formed a Bearish Engulfing Pattern at resistance. This puts my bias in favour of the bears.

EUR vs CAD

Bearish bias for the week.

This is EUR vs CAD weekly timeframe. We have a Berish Engulfing Pattern off the resistance level highlighted. More importantly, we have a bounce of 1,45. This puts my bias in favour of the bears.

CAD vs JPY

Bullish bias for the week.

This is CAD vs JPY weekly timeframe. Last week I did mention that the break below may be a bear trap (here). Price formed an Indecision Candle with a slighlty longer lower wick. In an ideal world, we would have gotten a Pinbar. But we do not always get ideal scenarios. This Indecision Candle is sufficient enough for me to establish a bullish bias for the week..

NZD vs CAD

Bearish bias for the week.

This is NZD vs CAD weekly timeframe. The red line I talked about last week (here) proved to be relevant. We do have a Bearish Engulfing Pattern off the red line. However, I am not strong bearish as price is still in the vicinity of Support.

GBP vs USD

Mixed signal.

This is GBP vs USD weekly timeframe. I did label this asset as mixed signal as there is no setup yet. Just like last week. However, I do see a rather bearish touch and will keep an eye on bearish setups. Price is close to resistance. Below resistance I am bearish. We may get a setup next week.

DAX30/GER30

Mixed signal (rather bullish).

This is DAX30/GER30 weekly timeframe. Last week I talked about the Pinbar. The Pinbar proved to be a rejection of lower prices. See here for last week analysis. Price is reaching a Double Top level, which would be rather bearish. And as long resistance has not been broken, resistance is treated as resistance. However, there is no setup yet. And with the strong surge up, I will be looking for long setups next week on pullbacks. And we know trends last longer than expected. Rather then trying to short a bullish trend, I'll look to go with the trend.

EUR vs JPY

Mixed signal.

This is EUR vs JPY weekly timeframe. Basically I would be bearish with after the strong close below 120 level. However, price is at support. I do not want to short an asset just above support. I could look for short setups on pullbacks and long setups as price dips in support. Or I rather keep my hands on my lap an observe prices. Which ever it is, I'll keep you updated here in my blog.

USD vs JPY

Bullish bias for the week.

This is USD vs JPY weekly timeframe. Price formed a Doji with the Open and Close on top of the support level. This puts my bias in favour of the bulls. A Doji alone is not really a setup. But this formation at this location signifies this very level.

SPX500

Bullish bias for the week.

This is SPX500 weekly timeframe. Even though I am weary of the bulls, we are in a bull market. Any trend can last longer than expected. With last week close as a Rejection Candle my bias for the week ahead is in favour of the bulls.

GBP vs JPY

Mixed signal.

This is GBP vs JPY weekly timeframe. We do have bout the same picture as last week (here). Price is still inside the congestion zone. Sooner or later it is going to break out.

USD vs CHF

Bullish bias for the week.

This is USD vs CHF weeky timeframe. In my analysis for last week I mentioned my skeptisim about the bearish indication (here). With last week did close above parity and formed a Bullish Engulfing Pattern. This puts my bias in favour of the bulls.

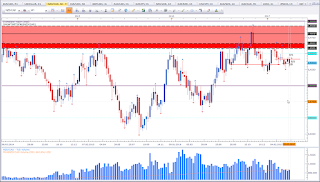

AUD vs USD

Bearish bias for the week.

This is AUD vs USD weekly timeframe. Price is at range resisance and is bouncing off resistance. As long price stays below resistance I am bearish. The previous week Bullish Engulfing Pattern did not have follow through. The closer price gets to resistance, the more interested I get in short setups.

EUR vs AUD

Mixed sigal.

This is EUR vs AUD weekly timeframe. Price did bounce off the orange rectangel. This level was highlighted and talked about in my analysis for last week (here). I also mentioned there is a likelyhood of price reaching the grey rectangel (last week it was a yellow rectangel). With last week close we have a Dark Cloud Cover formation which puts my bias in favour of the bears. However, as long price has not violated minor support below, I am not bearish but rather neutral.

EUR vs GBP

Mixed signal..

This is EUR vs GBP weekly timeframe. Basically the close below the 0,85 level in combination with the successiv lower highs would put my bias in favour of the bears. But there is a lot of support on the way down. Even though this is one of my favourite assets, I am not much inclined to trade this asset as of yet. Support starts with the recent lower wicks and extends till the yellow rectangle. Any shorts will be vulnerable.

NZD vs USD

Mixed signal.

This is NZD vs USD weekly timeframe. Price is still at an interesting level and has not moved much since the previous week. With USD strength in the background, there is likelyhood of breaking out to the downside. But more about this further down in the cross currency analysis.

US Oil

Bullish bias for the week.

This is US Oil weekly timeframe. Price did break out of the congestion zone on the top side. We have a close above the 50 level. This puts my bias in favour of the bulls.

Coming to the cross currency anaysis.

USD seems to gain strength accross most USD pairs. This is also reflected on the USDOLLAR chart. With EUR vs USD bearish bias and USD vs CHF bullish bias we have two setups in line with eachother. Both setups are reflected on USDOLLAR

This is USDOLLAR weeky timeframe. Last week did form a Pinbar right on top of support, which puts my bias in favour of the bulls. This is in line with my bearish bias on EUR vs USD and AUD vs USD as well as my bullish bias on USD vs CHF and USD vs JPY.

Considering the outlook of USD strength, I am more inclined to look for berish setups on GBP vs USD which is at resistance and a bearish Breakout on NZD vs USD, which is in a congestion zone.

Happy trading,

TT

Keine Kommentare:

Kommentar veröffentlichen